Advice

- Non-fungible tokens (NFT) are digital assets that are verifiably unique and create digital scarcity. They cannot be duplicated or divided.

- They have many use cases, including digital collectibles, song, artwork and game tokens.

crypts, utility tokens, security tokens, privacy tokens … digital assets and their classifications multiply and evolve along with the technology blockchain .

Non-fungible tokens (NFT) are another example of the rapid change in the industry. In this guide we explore what they are, how they work and how they are used.

What are non-fungible tokens?

Non-fungible tokens are digital assets that record unique information in smart contracts.

It is this information that makes each NFT unforgeable and, as such, cannot be directly substituted by another token. They cannot be exchanged for the same, since no two NFTs are alike. The bills, on the other hand, they can just swap with each other; if they have the same value, there is no difference for the holder, as an example, between one dollar bill and another.

Bitcoin it is a fungible token. You can send someone a Bitcoin and they can return one, and you still have a bitcoin. (Decidedly, Bitcoin's value can change throughout the exchange). You can also send or receive smaller amounts of Bitcoin, measurements in satoshis (think of satoshis as Bitcoin pennies), since fungible tokens are divisible.

Non-fungible tokens are not divisible, the same way you can't send someone half a concert ticket. A part of a concert ticket would not be worth anything on its own and would not be redeemable.

The collectibles of CryptoKitties were some of the first non-fungible tokens. Every blockchain-based digital kitty is unique; If you send someone a CryptoKitty and receive a CryptoKitty from someone else, the one you receive will be a totally different CryptoKitty from the one you sent. Collecting different digital kittens is the goal of the game.

The unique information of a non-fungible token, como un CryptoKitty, is stored in your smart contract and is immutable recorded in that token's blockchain. CryptoKitties was originally launched as ERC-721 tokens on the block chain Ethereum , but they have since migrated to their own blockchain, Flow, to facilitate the access of newcomers to cryptocurrency.

Did you know

At the end of 2018, one gamer was so desperate to move to a “best location” in the virtual game Decentraland who was willing to pay 2.800.000 MANA to buy land in the game. At the time of exchange, that equaled more than 215.200 Dollars.

What makes NFTs so special?

Non-fungible tokens have unique attributes; in general, are tied to a specific asset. Can be used to demonstrate ownership of digital items, like game characters, or even the ownership of physical assets.

Other tokens are fungible, in the same way as coins or bills. The fungible tokens are identical, have the same attributes and value when swapped.

How are non-fungible tokens used?

Like cryptos like CryptoKitties, non-fungible tokens can be used for digital assets that must be differentiated from each other to prove their value or scarcity. They can represent anything, from virtual terrestrial spaces, works of art up to property licenses.

Non-fungible tokens are not traded on standard crypto exchanges, rather they are bought or sold in digital markets such as Openbazaar or Decentraland's LAND market.

How do NFTs work?

Tokens like Bitcoin and those based ??on Ethereum ERC-20 they are fungible. Ethereum's non-fungible token standard, used by platforms like CryptoKitties and Decentraland, is ERC-721. Non-fungible tokens can also be created on other smart contract-enabled blockchains with tools and non-fungible token support.. Even though Ethereum was the first to be widely used, NEO , EOS and TRON now have NFT standards.

Non-fungible tokens and their smart contracts allow you to add detailed attributes such as the identity of the owner, metadata or secure file links. The power of non-fungible tokens as immutable proof of digital ownership is a major advance for an increasingly digital world. They could see the blockchain's promise of trustless security applied to the ownership or exchange of almost any asset..

Like the blockchain challenge to this day, non-fungible tokens, its protocols and technology of smart contracts are still being developed. Building decentralized apps and platforms for non-fungible token management and creation remains relatively challenging. There is also the challenge of creating a standard. The development of Blockchain technologies is fragmented, many developers are working on their own projects. Success may require unified protocols and interoperability.

How to buy NFT tokens

Non-fungible tokens can be purchased on a large number of NFT markets, as Rarible, OpenSea y Enjin Marketplace.

Next, We show you how to get your first NFT with Rarible:

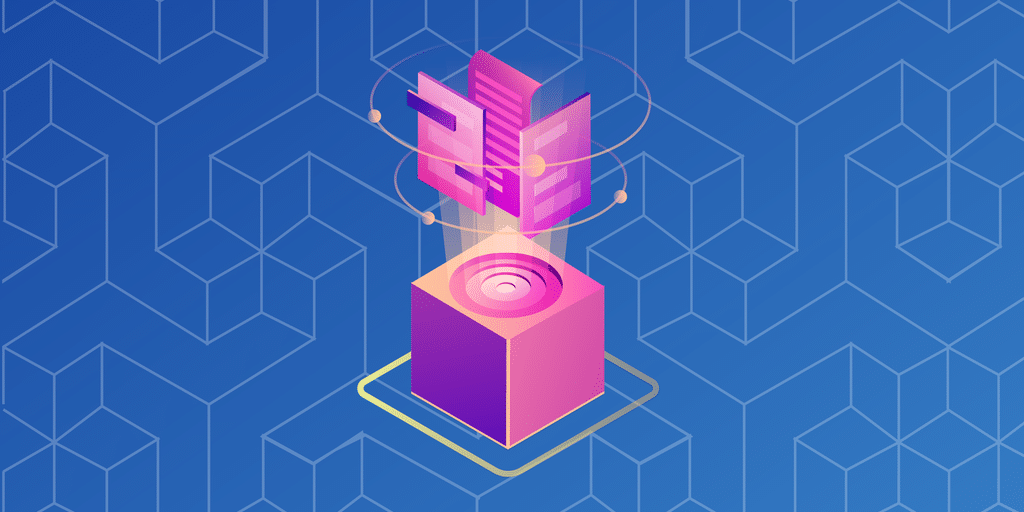

Paso 1: Go to site web of Rarible and click the button “Connect” in the upper right. From here, select the Ethereum wallet you want to connect to the platform and log in.

You must agree to the terms of service before you can have access .

In our example, we will connect using Metamask , a popular web and mobile wallet.

Paso 2: Once you have logged in, search the platform for the NFT you want to buy.

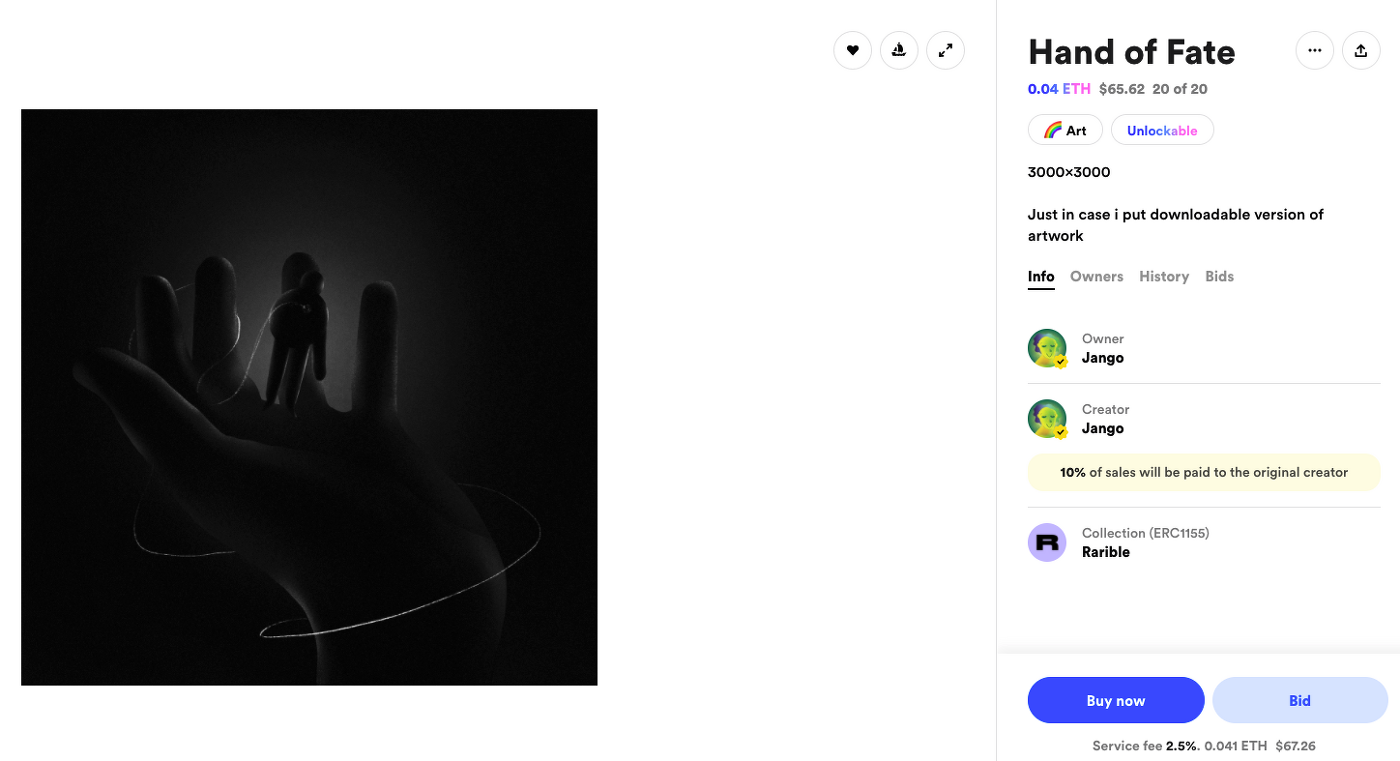

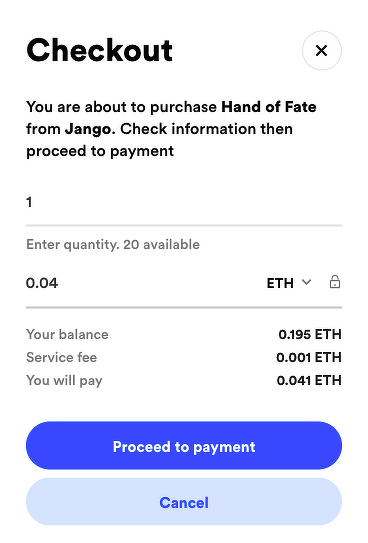

In our example, we will show how you can buy the artwork “Hand of Fate” of Jango. The procedure will be equivalent regardless of the NFT you want to buy (assuming it is available for purchase).

Once you have selected the NFT you want to buy, Click the button “Buy now”.

Paso 3: A confirmation window will appear asking you to double-check the order details.

If you agree to continue, Click the button “Proceed to payment” to continue with the last step.

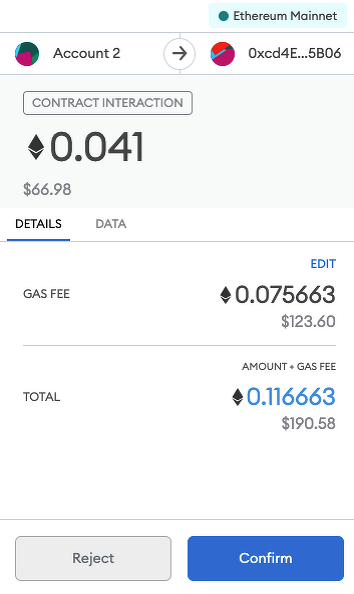

Paso 4: Next, a pop-up window will appear from your wallet asking you to confirm the transaction. Again, if you agree to continue, just confirm the transaction and it will be processed.

Once confirmed, your NFT will be deposited directly to your Ethereum address and will be yours.

Note: It is You may want to avoid buying your NFTs during peak hours, opposite case, you could end up paying an excessively high gas commission (as in our example below, it was paid $ 66.98 for work and $ 123, 6 in transaction fees).

Who is causing a sensation in the NFT space?

Virtue Earth

An important emerging market for NFTs is the creation of digital collectibles; like physical business cards, get value for their scarcity. Numerous brands have begun licensing their content for use in digital collectibles.; One of the companies at the forefront of the movement is Virtue Earth .

Terra Virtua is advertised as the “home of digital collectibles”, allowing fans to create a “Fancave” where they can display their NFT assets. In september this year, The company launched a licensed NFT series inspired by the The Godfather film trilogy.

The CEO of Terra Virtua, Gary Bracey, said to Decrypt that “Terra Virtua's main mission is to bring NFTs to the mainstream”, and added that the use of NFTs was inspired by an idea to unite the world. digital and the real world.

“We started to think a lot more about creating something a little more dynamic; the main catalyst was to provide something in the digital world that was not practical in the 'real' world”, added Bracey.

Super rare

Although Terra Virtua creates NFTs inspired by the big brands and Hollywood, other NFT markets are dedicated to art, another great NFT industry.

SuperRare is one of the major players in the emerging digital art space powered by NFT. As the name suggests, SuperRare is dedicated to providing a marketplace for rare and valuable digital art pieces. A SuperRare, artists' works are authenticated on the Ethereum Blockchain, which guarantees its value. Up to now, users have collected more than 11.000 artworks, according to him site web SuperRare .

Although, according to your web portal, SuperRare is only recruiting a “small number of artists selected one by one”, is doing a great business. In october 2020, SuperRare reported the sale of artwork worth 4 million dollars on its platform, and ??los artistas ganaron 4,6 million dollars after marketing more than 11.000 plays.

Decentraland

NFTs are also becoming increasingly prominent in the gaming space.. Decentraland is the world's first fully decentralized gaming world, built on ERC-20 MANA token. Users can spend MANA to buy goods, services and land in 10x10m of virtual land, backed by the non-fungible token LAND. Decentraland's ICO for the MANA token initially raised $ 20.7 million and sold out in five minutes. At a later LAND auction, users spent 161 million MANA to buy virtual packages, about $ 15 million at current prices.

The game world itself is equivalent to Minecraft; simple block graphics and user generated creations, ranging from art galleries (where NFT can be displayed) even simple games built within the game world.

Decentraland supports a number of different NFTs at the same time from LAND, included Axie Infinity and the always popular CryptoKitties .

NFT y DeFi

Non-fungible tokens are also causing a stir in one of the most intriguing and innovative spaces in the world. cryptos, the space of decentralized finance ( DeFi ).

An example of how NFTs are used in DeFi is Aavegotchi , an experimental startup funded by the DeFi money market, Aave. Aavegotchis are NFT cryptos used in a gaming universe; Each Aavegotchi also has Aave Tokens locked up as collateral, which means that each one generates a return on Aave. If the owner liquidates his participation, the Aavegotchi disappears.

1 / Juega para ganar ??

The Aavegotchi universe is closed-loop, designed to reward active members.

Buy $ GHST to start, then earn it by playing games, voting and participating in rarity farming, a new variant of cash draw that rewards the rarest Aavegotchis with $ GHST . pic.twitter.com/X5mYRZGqev

– Aavegotchi (aaveaavegotchi) 10 September 2020

Another service that aims to bridge the gap between the DeFi and NFT communities is Rarible , a decentralized application (the dapp for short) that enables users to commercialize digital works of art in the Rarible market.

In july 2020, Rarible launched RARI, a governance token that is used to reward creators and collectors; It can only be earned through active participation on the platform, a procedure that Rarible calls “market liquidity mining”.

Rarible market is, in connection with other markets, enormous. Based on data published by Dune Analytics, Rarible has dominated NFT sales since September 2020.

If Rarible continues to dominate this industry, so DeFi is on its way to becoming synonymous with non-fungible tokens. The NFT industry may be young, but for some, is full of potential.

“The race has not started yet, this is just the warm-up”, Bracey said to Decrypt Recently.

Recent developments

The NFT space grew steadily in 2020, with a report from January 2021 from DappRadar which reveals that daily activity through blockchain games grew by 35% during 2020 to around 28,000 daily active unique wallets. In february 2020, the NFT Rarible market raised $ 1.75 millions in seed funds from prominent names in the industry, such as Coinbase Ventures.

In the meantime, NFTs began to change hands for exorbitant sums. Teen artist FEWOCiOUS sold NFT artwork for tens of hundreds of dollars; a Sorare business card depicting soccer player Kylian Mbappé sold for almost $ 65,000; at a Nifty Gateway auction of digital artist Beeple's work, a bidder paid $ 777,777 for a collection of pieces at the last second; an image of 24×24 pixels sold for 176.000 Dollars. The NFT craze hit new prices in February 2020, when an Ethereum project called Hashmasks saw 16,000 NFT art pieces sold by $ 9 millions.

The large amounts of money were accompanied by increasingly important names, given that artists and celebrities took advantage of the possibility to make a profit. Rapper Lil Yachty, rick's creator & Morty Justin Roiland, DJ Deadmau5 and YouTuber Logan Paul were among those who launched NFT.

The future of NFTs

For the moment, much of the attention around non-fungible tokens is focused on artwork, collectible games and crypto. The fantastic soccer game Sorare has recruited 100 soccer clubs for your platform, while the smurfs, BBC's Minecraft and Doctor Who have become NFT.

In the case of games, non-fungible tokens could be used to represent game objects, as characters, which makes it possible for them to transfer them to new games or exchange them with other players.

However, its potential is much broader, with possible application to copyright and intellectual property rights, ticket sales, and video game marketing.

Non-fungible tokens add potential to the creation of security tokens, the tokenization of both digital and real-world assets. Physical assets, such as properties, could be tokenized for fractional or shared ownership. If these security tokens are non-fungible, the ownership of the assets is completely traceable and clear, even if only tokens that represent partial ownership are sold.

Other applications of non-fungible tokens could be certification, as an example, of titles, software licenses, guarantee certificates and even birth and death certificates. The smart contract for an immutable non-fungible token proves the identity of the recipient or owner and could be stored in a digital wallet for easy access and representation. One day, our digital wallets could contain proof of all certificates, licenses and assets we own.